Happy New Year!

January 2, 2020

Happy New Year!

Let’s get RICH in 2020

When my children were young we started saving coins in a five-gallon jug. We told them that when it got filled to the top, we would take a family vacation to Disney World. My husband was the main contributor and there were hiccups along the way complete with teaching lessons about stealing from the jug. But it never occurred to us just how long it might take to fill up that big-ol’-jug. Come to find out, it took about fifteen years. And now the last place our teens want to go is Disney World.

Growing up myself, we never took extravagant family vacations the way families do today. Our biggest vacation was camping in The Dells and going to Noah’s Ark. With this history along with being a firm believer of not going on vacation unless we can afford it and not often having the ability to take the time away from our business, I will admit our family vacations have been few (and only involved an airplane once) - something our kids remind us of often!

To compound this further, just thinking about all of the planning that goes into a vacation stresses me out. Planning for the vacation and activities is tough enough but when you add my gluten allergy to the docket, traveling becomes nightmarish at times. Not only that, but I feel like it is a burden to my family (although they would deny this) - it is a concern to them every place we go to eat, they are always disappointed when I get sick, and they are worried if they think I didn’t get enough to eat. To save my sanity in planning, my stomach in cross-contamination, and my family’s worries, along with my other “excuses”, I really have dragged my feet in pursuing a vacation.

But now my time is up. We have a full jug. We have saved for a vacation. Our son’s college roommate is from a warm place and he can help guide us with many things. So the Babcock’s are about to venture into our first “real” family vacation.

We revealed our plans to our kids at Thanksgiving so that they would know this vacation is also their Christmas gift (we were sure that jug didn’t hold enough to afford everything). They were thrilled with the news but also excited to find out how much money was in our jug.

We consulted Google on how much it might contain. We studied the jug’s coin ratio - all quarters is certainly different than the mixture we had. We weighed the jug to discover it was 163 pounds. Then our sons rolled it to the stairs on an office chair, clunked it all the way down the stairs, shuffled it to the doorway and hauled it to the garage. They sawed off the top to move some of the coins into a different bucket and took them to the bank. How much do you think it contained? After fifteen years of saving 163 pounds of coins, we now have $1923 to go towards our vacation. Wow, we never considered it could be that much!

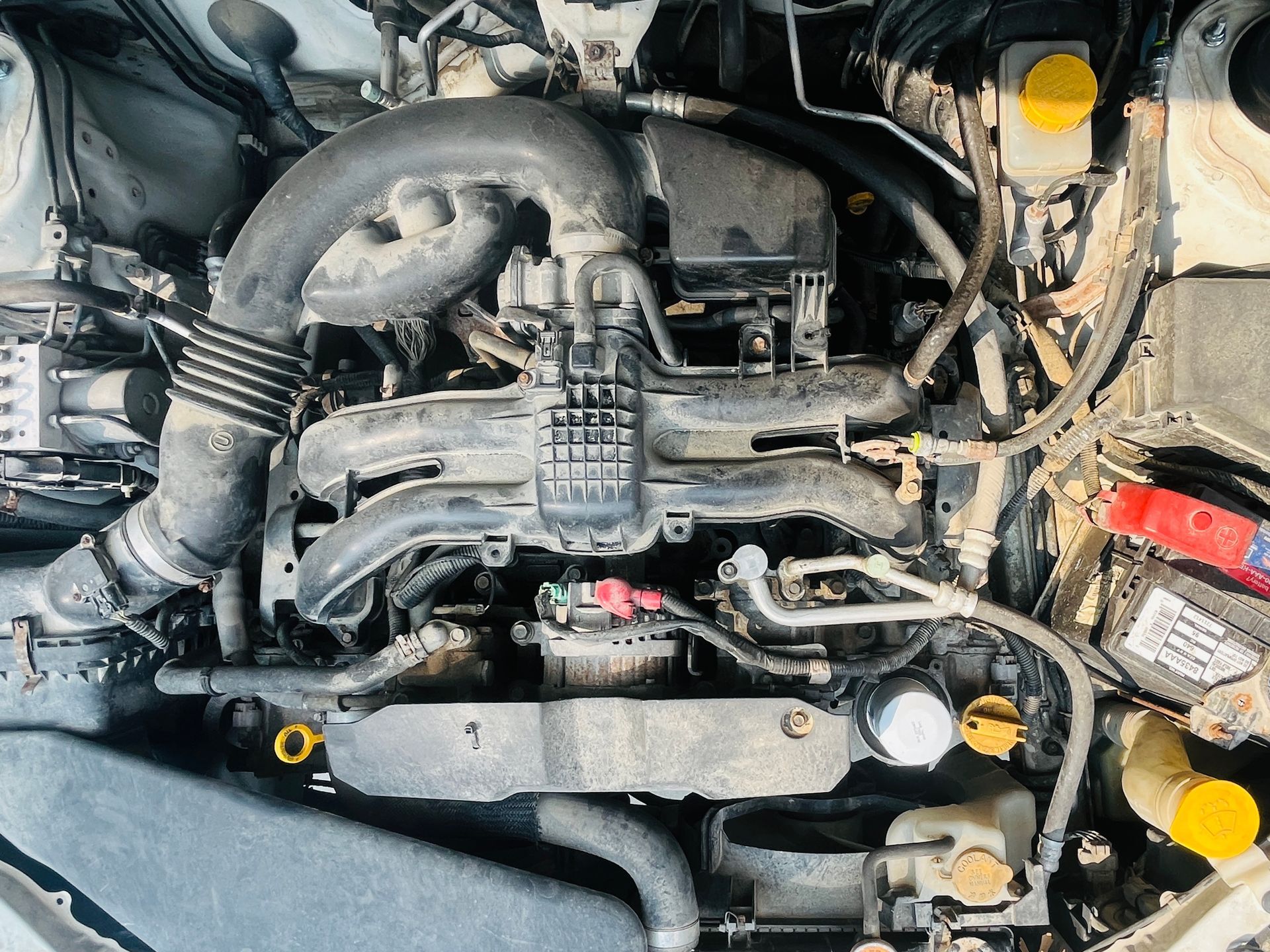

Has this ever happened to you - having something of value in your possession and not really considering how valuable it really is? What about your vehicle? And what if you truly own your vehicle - it’s paid off? Or what if it’s nearly paid off? Do you consider the real value of that? Or are you one to pay it off and then upgrade to a newer model vehicle? Do you consider all of the costs associated with a new or newer-to-you vehicle?

Years ago I learned about a website that reveals the “true cost of ownership”: edmonds.com/tco.html . This website link contains a pricing tool that calculates all of the costs of ownership over a five-year period. When buying a new or newer car you probably consider that there will be costs associated with fuel, maintenance, and repairs. But there are a few things you may not have thought about including depreciation, loan interest, taxes/fees, and increased insurance premiums. If you are in the market for a new vehicle, I encourage you to check it out to help you make a more informed decision regarding the different vehicles you may be considering. Of course, it’s important to keep in mind, it is not an exact tool as every person’s usage and circumstances vary - but it is helpful in giving you a general idea of what to expect.

Now, what if, instead of buying a new vehicle you consider the value of your current vehicle and what it might afford you? Assuming your vehicle is paid off or has a significantly lower payment than a new one would, here are some reasons to love it even more:

- Richer at retirement. With the average monthly car payment at $530 new and $381 used, this equals a yearly payment on the high end of over $6000. That’s over $30,000 in 5 years. If you kept some of that aside to keep your current car running well, say $1000/year beyond what you already save for a car fund, you could still stash a nice chunk into a retirement fund — say $5000/year. With a modest return of 6% per year, you could have around $30,000 in five years and if you let it grow another 25 years at the 6%, it would be over $125,000. Would that be worth extending the time with your current vehicle?

- Richer emergency fund or giving fund. If you are already on track for retirement, you could save the extra dough from not having more of a car payment or staying with your current low payment - say put away $300/month. That’s $3,600 in a year and $18,000 in five years (not including interest). You could add all that cash to your emergency fund so you are better prepared for unknown events like a job loss or a health crisis. And if you are still healthy with a job after that five years, you could use that to pay for a good new-to-you vehicle in cash - and if you keep up that cycle, you may never have a car payment again! Or you could always donate it to your favorite church or charity — allowing you to be a different kind of rich.

- Richer peace of mind. When everything is going well and you can afford a car payment based on your income, it doesn’t seem like a bad idea. You may feel a new car gives you peace of mind - at least while it’s under warranty. But what about other kinds of peace of mind? When your vehicle is newer, are you extra protective with everything about your car - eating in it, keeping it spotless, freaking out over a little scratch? I know I am. But there is something a little bit freeing about driving an older car - you can still keep it clean and looking good like an old pair of jeans, but the little rips and scratches might just not seem so horrible. It’s also quite freeing to live below your means - so that when something unexpected happens, you are prepared. When you are strapped - meaning every cent you make is accounted for with all the things and niceties you have, it can be a stressful kind of living. If there is no margin and your circumstances change for the worse, what then? Having no car payment or a low payment and saving the rest will definitely give you more peace of mind.

- Richer in more ways. Richer in more ways. As vehicles age, the cost of insuring them decreases. This is even more dramatic if you are able to drop the collision coverage and switch to liability only if it makes sense to you. And you can also save a lot on yearly license plate tabs - which are considerably less for older vehicles. As we move into 2020, wouldn’t it be great to make it a richer year? Richer financially by making informed and wise decisions in how you spend your money? Richer peace of mind by saving for emergencies, retirement, vehicles, etc. Richer in wisdom by making the decision to save money for the extra things you want and places you want to go so you aren’t just incurring more debt to have nice stuff or go to nice places? Richer in your heart by giving and being generous?

There are so many ways we can be richer in our lives - one of which I have not yet mentioned: Richer in memories. That’s one of the first richer things I am going to try my hand at this year as I plan and prepare for our prepaid trip to Puerto Rico! My heart is near to bursting in what a memorable and precious trip it will be with my most favorite people.

How will you join me in being RICH in 2020?